As a real estate professional, understanding the latest information on property taxes in Houston is essential for helping your clients buy or sell a home. Property taxes play a crucial role in the home-buying process, and staying updated on the current rates and regulations can enhance your expertise and trustworthiness. Ready to dive in? Let’s explore the latest Houston property tax information.

Houston property taxes in 2025

Houston, Texas, is not only the largest city in the state but also the fourth-largest city in the U.S., with a population of over 2.3 million residents. Known for its rich culture, dining, and attractions like the Space Center Houston, it’s no wonder that many people are eager to call Houston home.

What do property taxes fund in Houston?

Property taxes play a vital role in supporting essential local services, including:

- Education – Houston ISD, the largest school district in Texas, relies on tax revenue to fund school operations.

- Public Safety – Police, fire departments, and emergency services depend on these funds to serve the community.

- Infrastructure – Property taxes help maintain and improve roads, public transportation, and utilities.

- Local Government Services – Funding supports waste collection, public parks, and various community programs.

As Houston’s population grows and property values rise, these tax revenues become even more critical in sustaining city services.

How are property taxes are calculated in Houston

Property taxes in Houston are calculated based on the assessed value of the property and the tax rate. The formula is simple:

Property Tax = Assessed Value x (Tax Rate / 100)

Here’s a breakdown of the key components involved:

- Assessed Value: The Harris County Appraisal District (HCAD) determines the assessed value of properties each year. This is based on market conditions, property improvements, and other factors. The assessed value may differ from the market value.

- Tax Rate: Property tax rates are expressed as rates per $100 of the assessed value. The tax rate varies depending on the taxing district. For instance the City of Houston will have a different tax rate than Harris County.

What are the current Houston property tax rates?

Property tax rates in Houston vary based on your location, as each taxing district sets its own rate. The total amount you owe depends on which district applies to your property. As of 2025, the base tax rates for key jurisdictions within Harris County are:

- City of Houston: $0.51919 per $100 of assessed value

- Harris County: $0.38529 per $100 of assessed value

- Houston Independent School District (ISD): $0.86830 per $100 of assessed value

In addition to these rates, some properties may be subject to extra taxes from municipal utility districts (MUDs) or other special taxing entities, which can increase the overall tax rate for a given property. It’s important to know which districts the property falls in to determine its accurate property tax rate.

Will Houston property taxes rise in 2025?

In Houston, property taxes are based on the market value of a home as of January 1 each year. While home prices have fluctuated in recent years, the city’s property tax rate has remained relatively stable and has even decreased slightly over time.

As a result, significant tax rate increases are unlikely for most homeowners in 2025. However, a property’s assessed value may still change depending on shifts in the local real estate market and result in increased property taxes.

Nearby cities and their property tax rates

If you’re considering buying or selling outside Houston but still within the Greater Houston area, here’s a quick look at the property tax rates in nearby cities:

- Deer Park: $0.72000 per $100 of assessed value

- La Porter: $0.710000 per $100 of assessed value

- Bellaire: $0.43330 per $100 of assessed value

- Katy: $0.42500 per $100 of assessed value

- Jersey Village: $0.78700 per $100 of assessed value

Important dates for Houston property taxes

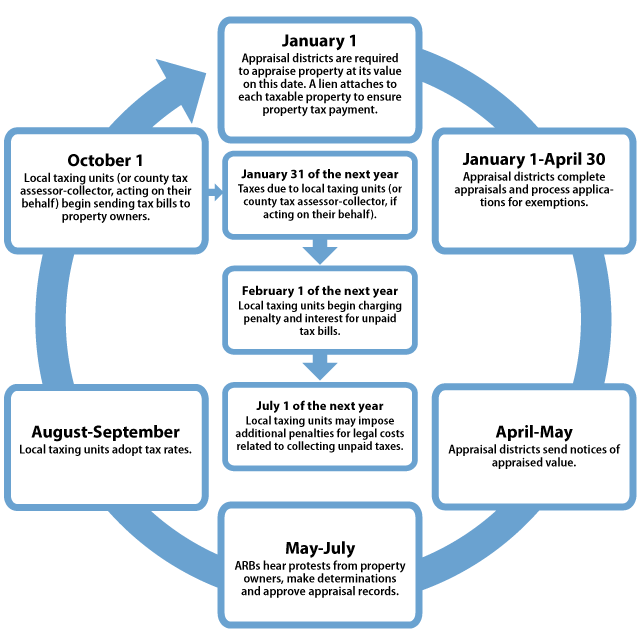

When moving to or buying property in Houston, it’s essential to be aware of key dates in the property tax cycle:

- January 1: Property assessments begin

- January 1 – April 30: Applications for exemptions and tax relief

- May 15: Appraisal review process begins

- September – October: Tax rate adoption

- October – November: Property tax collection begins

- January 31 (of the following year): Deadline for paying property taxes

- February 1 (of the following year): Penalty and interest charges start for late payments

Understanding Houston property tax rates is essential for success

Understanding Houston’s property tax system is essential for both homebuyers and sellers looking to navigate the local real estate market with confidence. While tax rates remain relatively stable, fluctuations in assessed property values can impact overall tax bills, making it crucial to stay informed about potential changes.

For real estate professionals, being knowledgeable about Houston’s property tax rates and deadlines positions you as a trusted resource for your clients. Whether they need guidance on estimating their tax burden or understanding how property taxes contribute to the community, your expertise can help them make well-informed decisions.

By staying up to date with the latest tax information, you can better serve your clients and strengthen your reputation as a go-to real estate expert in the Houston market.

Need Real Estate Photos in Houston?

As you navigate the Houston real estate market, partnering with a professional photography service can give your listings a competitive edge. At Virtuance, we specialize in HDReal® powered images, 3D tours, aerial photography, and marketing enhancements to help your listings stand out and sell faster.

Ready to list a property in Houston? Contact Virtuance for high-quality visual solutions that help your listings shine!

This blog provides general information based on credible sources. Property tax rates and information are subject to change. For personalized advice, please consult a tax professional or local authority.

FAQ

Property taxes are calculated by multiplying the assessed property value by the tax rate, which varies by district.

Yes, while rates have remained stable, assessed property values can fluctuate, impacting overall tax bills.

Property taxes are due by January 31 of the following year, with penalties starting on February 1.